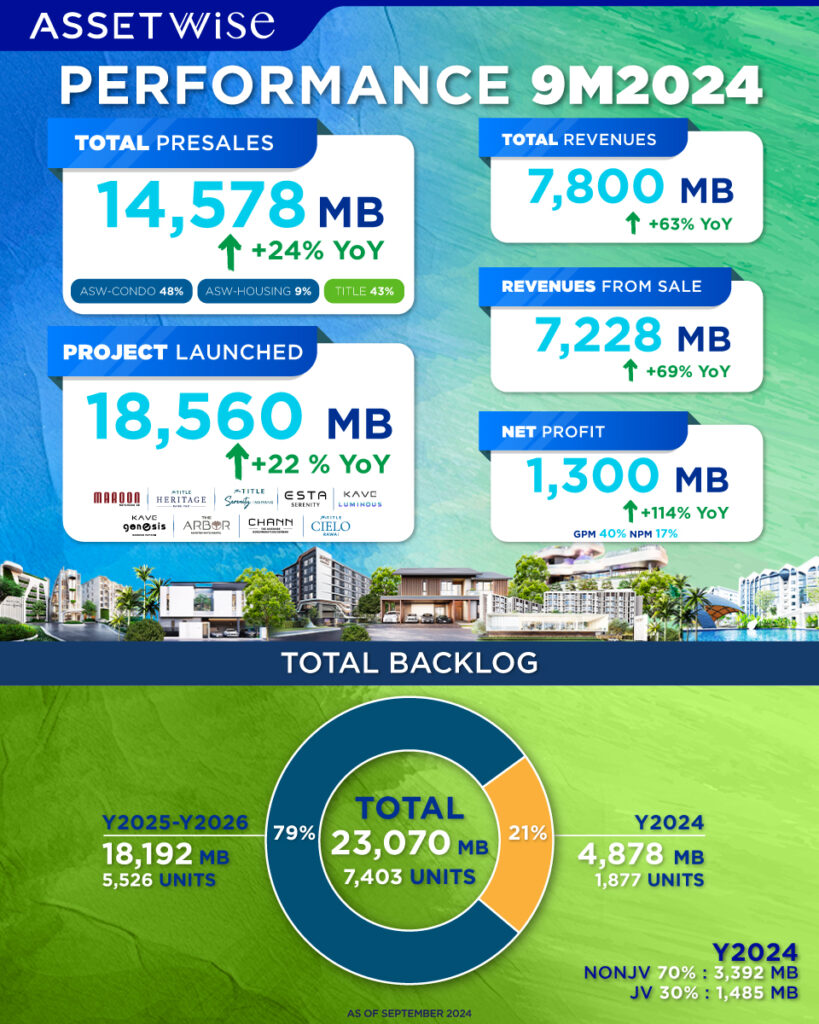

- In the first 9 months of 2024, AssetWise reported a revenue of 7.8 billion Baht, representing a 63% increase compared to the same period last year. This figure accounts for 90% of the annual sales target.

- The company achieved a net profit of 1.3 billion Baht, reflecting a 114% growth and currently holds a backlog of 23 billion Baht, which is expected to be recognized as revenue through 2026.

- AssetWise has launched a total of 13 development projects, with a combined value of 36.82 billion Baht.

- The company plans to introduce 4 large-scale properties under the brand “KAVALON”, which is a campus condominium near Bangkok University, as well as new developments in Phuket and Pattaya, capitalising on the booming tourism industry.

- ASW focuses on three core strategies to achieve its 8.7 billion Baht revenue target: exploring new frontiers, strengthening brand recognition, and maintaining a high ownership transfer rate.

ASW demonstrates strong financial performance in the first 9 months of 2024, with revenue of 7.8 billion Baht and a net profit of 1.3 billion Baht, reflecting a 63% increase in revenue and a 114% growth in profit year-on-year. The company also reports a backlog of 23.07 billion Baht, with income expected to be realised steadily until 2026. AssetWise is progressing with 13 new development projects, valued at a total of 36.8 billion Baht, four of which are set to launch by the end of the year. One of these is the “KAVALON”, a campus condominium next to Bangkok University. The company’s strategies focus on expanding in tourism-driven areas like Pattaya and Phuket, capitalising on the post-pandemic tourism boom; exploring new frontiers and enhancing the rate of ownership transfers. These initiatives are expected to help the company reach its revenue target of 8.7 billion Baht.

Mr. Kromchet Vipanpong, Chief Executive Officer of AssetWise Public Company Limited (ASW), shared that the company’s performance for the first nine months of 2024 (January–September) shows revenue of 7.8 billion Baht, which represents a 63% year-on-year growth compared to the same period in 2023. This amount constitutes 90% of the company’s revenue target for 2024, set at 8.7 billion Baht. The company also reports a net profit of 1.3 billion Baht, reflecting a 114% increase from last year.

The projects with the highest property ownership transfer rates in the third quarter of 2024 were Kave Town Island, a campus condominium next to Bangkok University valued at 3.5 billion Baht, and THE TITEL HALO 1, a 1.5 billion Baht leisure condominium developed by AssetWise’s affiliate, Rhom Bho Property Public Company Limited (TITLE). These two projects have enabled the company to continuously recognize income since the second quarter of 2024. Since January 2024, the company has achieved pre-sales revenue of 14.6 billion Baht from its existing residential projects, representing a 24% growth and accounting for 82% of its total revenue target of 17.8 billion Baht.

With a backlog of 23 billion Baht at the end of the third quarter of 2024, the company is positioned for strong financial performance, allowing it to recognize revenue through 2026.

Mr. Kromchet Vipanpong, CEO of ASW, also mentioned that the company has decided to launch 13 new projects in 2024, with a total value of 36.82 billion Baht. This represents a 42% increase over the initial plan announced at the beginning of the year and a 22% increase compared to that in the last year. The strategic adjustment is driven by:

- The growing popularity of tourism in Phuket since the start of 2024, with the number of tourists from January to September reaching 7.36 million, a 22.57% increase compared to the same period last year.

- The strong sales performance of the company’s development projects in strategic locations this year.

As a result, the company aims to capitalize on this opportunity by launching new development projects in key tourist destinations, such as Phang Nga and Phuket, before the end of the year.

In the fourth quarter of 2024, the company plans to launch four new development projects:

- Aquarous Jomtien Pattaya, a luxury condominium under the concept of “Luxurious Staycation Residence,” featuring 606 residential units and extensive amenities, valued at 5 billion Baht.

- Kavalon, a campus condominium located next to Bangkok University, offering 2,192 residential units designed for university students, faculty, and investors. This project is valued at 4.5 billion Baht.

- THE MODEVA, a leisure residence with 859 residential units situated just 500 meters from the renowned Bang Tao Beach. This project is valued at 6.2 billion Baht.

- THE TITLE ARTRIO BANG-TAO, a leisure residence with 435 units located near Porto de Phuket and other lifestyle facilities. This project is valued at 2.6 billion Baht.

Mr. Kromchet Vipanpong, CEO of ASW, explained that the company’s strategy of capitalizing on new frontiers with strong economic potential, such as Phuket, combined with ASW’s and TITLE’s strong brand recognition, has bolstered customer confidence —both local and international— in the quality of their developments. This has been instrumental in achieving sales targets and maintaining high ownership transfer rates across all projects. Additionally, expanding the property portfolio with new ventures focused on generating recurring income will further support the company’s sales targets and long-term growth.AssetWise Public Company Limited (ASW) has established itself as a key player in property development in prime locations, guided by the philosophy “We Build Happiness.” Currently, the company has developed over 71 condominium and residential projects under various brands to meet the diverse needs of its customers, including KAVE, ATMOZ, MODIZ, ESTA, THE ARBOR, THE HONOR, and TITLE, in partnership with Rhom Bho Property Public Company Limited. With a total project value exceeding 103.3 billion Baht, ASW reported a realised backlog of approximately 23.070 billion Baht in the third quarter of 2024, showcasing 53 completed projects and 18 ongoing developments.